A new employee, joined central government service on 31.03.2025 (UPS starts from 01.04.2025)

Assumption as on 15th April 2025

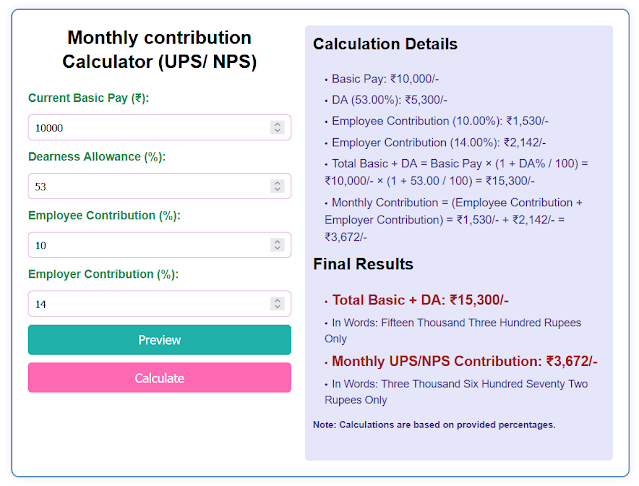

1. An employee with current Basic Pay Rs 10,000/-

2. DA: 53%

3. Annual increment in January: 3%

4. Increase in DA/year in January: 7%

5. Pay commission in 2026 and every 10 years.

6. Special increase in DA due to pay commission: 10%.

7. Length of service: 35 years (Retirement at age 60)

8. Withdrawal at age 60: 60% of Individual corpus (Employee + Employer's contribution combined)

9. Annuity plan's return: 7%.

10. Amount accumulated in NPS before 01.04.2025: 0

11. No change in basic pay apart from annual increment. No promotion considered.

Let us calculate between NPS and UPS, which is beneficial for him/her

NPS

Employee Contribution (%): 10%

Employer Contribution (%): 14%

Individual corpus* (2060, Age 60): Rs 2,57,91,507/- (Rs 2.58 Cr)

Withdrawal 60% at retirement of *: ₹1,54,74,904/- (Rs 1.6 Cr)

Pension Corpus of *: ₹1,03,16,603/- (Rs 1.03 Cr)

Pension per Month: ₹60,180/- (Rs 60k) (Fixed, Not linked to DA/DR)

UPS

Employee Contribution (%): 10%

Employer Contribution (%): 10%

Individual corpus**: ₹2,14,92,922/- (Rs 2.15 Cr)

Basic Pay at retirement (2060, Age 60): ₹2,78,978/-

DR at retirement (2060, Age 60): 28%

Lump Sum Amount (Service Benefit): ₹24,99,643/- (Rs 25L)

Withdrawal 60% at retirement of **: ₹1,28,95,753/- (Rs 1.3 Cr)

Pension per Month: ₹55,796/- + DR (with 28% DR, Rs 71,418/-)

Withdrawal 0% at retirement of **: ₹0/- (Rs 0)

Pension per Month: ₹1,39,489/- + DR (with 28% DR, Rs 1,78,546/-)

Pension amount to be received: NPS after 60% withdrawal vs UPS after 60% withdrawal at retirement at age 60 (2060)

NPS: Rs 60k (Fixed)

UPS: Rs 71k/- (₹56k/- + DR), assuming DR 28%

Total amount to be received: NPS after 60% withdrawal vs UPS after 60% withdrawal at retirement at age 60 (2060)

NPS: Rs 1.6 Cr

UPS: Rs 25L + Rs 1.30 Cr = 1.55 Cr

Pension amount to be received: NPS after 60% withdrawal vs UPS after 0% withdrawal at retirement at age 60 (2060)

Table: Pension and Total Amount to be Received at Retirement (2060)

| Category | Pension Amount (₹/month) | Total Amount (₹) |

|---|---|---|

| NPS (60% Withdrawal) | 60,000 (fixed) | 1.6 Cr |

| UPS (60% Withdrawal) | 71,000 (56,000 + DR), DR, 28% in 2060 | 1.55 Cr |

| UPS (0% Withdrawal) | 178,000 (139,000 + DR), DR, 28% in 2060 | 25 L |

Conclusion

As per eFinance365.com team, using Unified pension scheme, UPS calculator and National pension scheme, NPS calculator

UPS with 60% withdrawal appears beneficial than NPS with 60% withdrawal.

Calculation screenshots

NPS Screenshot 1

NPS Screenshot 2

NPS Screenshot 3

UPS Screenshot 1

UPS Screenshot 2

UPS Screenshot 3

UPS Screenshot 4

UPS Screenshot 5

Conclusion

As per eFinance365.com team, using Unified pension scheme, UPS calculator and National pension scheme, NPS calculator

UPS with 60% withdrawal appears beneficial than NPS with 60% withdrawal.

Reference

https://www.efinance365.com/2025/04/ups-calculator-only-calculator-you-need.html

%20www.efinance365.com.png)

%20Basic%20and%20DA%20prediction%20calculator%20www.eFinance365.com.jpg)

%20www.efinance365.com.png)

%20Individual%20corpus%20www.eFinance365.com.jpg)

%20calculator%20www.eFinance365.com.jpg)

%20Monthly%20contribution%20calculator%20www.eFinance365.com.jpg)

0 Comments